Stack Sats, Not Stacks (STX)

A deep - but simplified - look into the stacks blockchain and its dangerously alluring and dishonest tactics to attract novice Bitcoiners.

I have been hearing about this “revolutionary” project that is building on the “top” of Bitcoin. I have seen a couple of spaces being hosted on Twitter by the CEO of the project and the project’s official Twitter account. I jumped into a couple of these spaces to hear what the buzz was all about. After listening to the “experts” panel on this project, my BS meter went as green as the fear and greed index for bitcoin during the last bull run. This project is none other than the Stacks Blockchain.

I’m taking the time to write this article because I fear that the tactics being used by the marketing department of stacks, can influence newcomers to bitcoin and stray them down a path to shitcoinery. Or even worst - to lose all of their precious corn.

Researching into this project was painful. It started to become more painful as I proceeded to peel its layers apart - sort of like when you peel a fresh onion and it makes you cry - I just wanted to put together a comprehensive dissection of this ambulatory crypto zombie, that can be easily digested by new plebs.

Let us dive into stacks blockchain - Muneeb Ali is the founder and CEO of Hiro PBC (Hiro used to be Blockstack PBC). He is a computer scientist and internet entrepreneur. One of his listed accomplishments is the regulatory framework that allowed him to obtain the first SEC-qualified offering for a crypto asset. Yes, This token is a SECURITY, and they wear it on their chest! Is this decentralized? Doesn’t seem that way to me. Another question that came to me was, why did they change their name? Just a brand refresh - at least that is what the CEO claims. Blockstack’s mission was a little too broad and they wanted to narrow their focus after the release of Stacks v2.0 blockchain. This sounds a bit like PR to me, and I assume that there were other major legal reasons why, but that is my opinion.

Hiro PBC, then Blockstack got funding from the ICO (initial coin offering) era during the 2017 bull market - they raised 25 million dollars from many private investors. The Genesis block was released on October 30th, 2018. The main purpose of stacks v1 was to enable registration of digital assets and contracts with stacks tokens (STX) and to distribute stacks tokens arbitrarily to the initial investors, also known as a pre-mine. Blockstack at the time they raised the ICO money claimed they would release the majority of the capital after self-imposed specific milestones were reached. They said they were doing this to “protect” investors and the decision on whether they reached these milestones was through, what they called, an “independent” advisory board. This advisory board was composed of seven members.

Going through the background of these members I found out who they were and their ties as investors of Blockstack; so not a so independent advisory board. Arvind Narayanan - is recognized for his research in the de-anonymization of data. Arianna Simpson - general partner at a16z crypto (quite controversial as of late), a fund that invests in web3 startups. Catherine Tucker - Professor of Marketing at MIT and co-founder of the MIT crypto-economics lab, she has provided expert testimony to companies such as Facebook, Microsoft, and US debtors (Nortel Bankruptcy Proceedings). Charlie Saravia - Managing director at Harvard Management Company, he used to work for JP Morgan asset and wealth management. Koen Langedoen - professor of computer science. Rodolfo Gonzales Partner at Foundation Capital and is an investor in Blockstack as well as other cryptocurrency projects. Zavain Dar - Investor in tech companies and Blockstack. So, I assume that at the time of the release of the Stacks Blockchain genesis block these advisors had some form of economic gains incentives.

Once I started to uncover some of the information on the stacks blockchain roadmap website, I realized this is yet another Ethereum “wanna-be”. Yet another blockchain trying to solve “problems” in Bitcoin that don’t really exist, or are currently being worked on; at the pace Bitcoin allows. This is a behavior typical of computer engineers that enter the cryptocurrency space - they always want to break things and build fast.

To utilize the stacks blockchain, participants had to “burn” (send their Bitcoin to a wallet address where they were going to be lost for the rest of the time) to get the chain’s native token (STX), and the fuel cost (yes, just like Ethereum's) was to be paid in Bitcoin. If this doesn’t make you raise an eyebrow, keep reading. They called this token burn mechanism proof-of-burn (PoB). Why would anyone destroy their Bitcoin to operate on this blockchain when there are hundreds of others that do the same without the insane opportunity cost? This was clear to me after reading the original white paper, and as it turned out the developers and marketers of stacks realized this as well.

Their ESG’esque inspired the idea of proof-of-burn, a mechanism they claim reused other proof-of-work chain tokens (in this case exclusively Bitcoins) to prove that some type of energy was ultimately used to secure their blockchain and mine STX, A CRYPTO PARASITE of sorts. They argued that utilizing this method makes their chain greener to run. Send Bitcoin to a burn address (their version of mining) - get STX, and use STX for their applications in the form of gas. Apps that aren’t solving any problems but rather just a solution looking for problems, like every other altcoin.

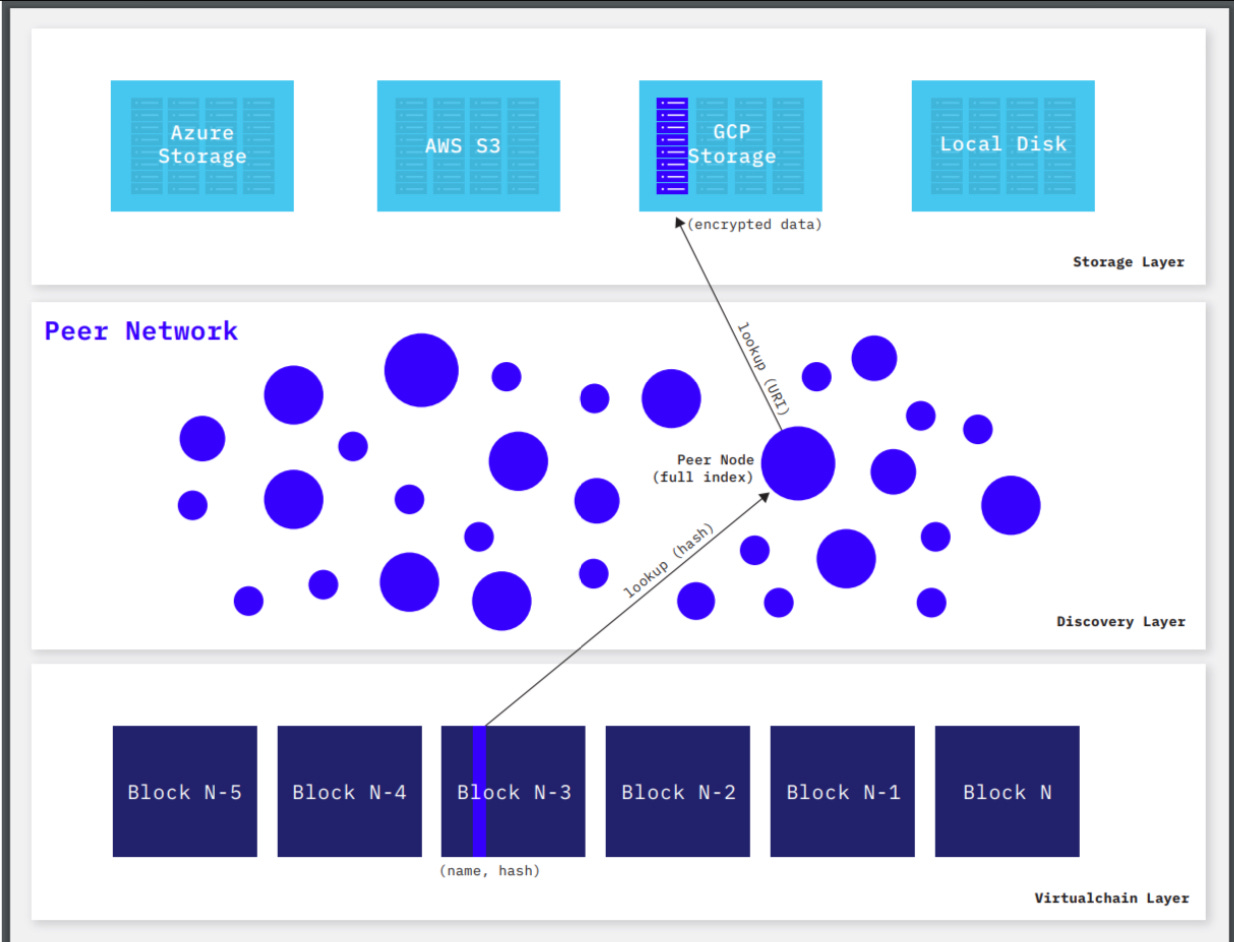

One of the main use cases for stacks - Creating “decentralized” storage using their blockchain and their node system called Atlas and Gaia.

The Stacks Blockchain’s main use case is storage, but the funny thing is, that blockchains are not good at storing anything. So what is their big solution? Well, the end-user or developer handles all of the backends for the Stacks applications to work. As said, they provide the storage drives (hard drives, SSDs, etc.) or use a fully centralized cloud storage service like google drive, dropbox, amazon, or remote network storage, all very vulnerable in their own way. All the Stacks blockchain and atlas system (validator nodes) are doing, is storing POINTERS (sort of like an address that tells a program where to look for specific data an app is asking for) to Gaia. Gaia is what they call these user-provided storage devices or your cloud storage provider. See any issues there? No?

There’s nothing genius about stacks, using their blockchain only overcomplicates something that we do every day simply and efficiently. There’s absolutely no decentralization here and no true value incentives. The scammy team at stacks calls all of the centralized storage devices you would use to actually store your data “dumb” drives. They say that these centralized storage providers can only see encrypted data, the cloud provider only sees a blob of encrypted data. That sounds fantastic, But they fail to mention that this is not decentralization at all. Why? Because your data is not being held by you or the “blockchain” but, by servers that belong to Jeff Bezos. In their white paper, they claim that the whole design philosophy of Gaia is to reuse existing cloud providers' infrastructure. LOL, I truly have no words for this. Yet to the whole stacks team this seems ok and decentralized.

They even have the balls to say that people using their blockchain benefit from fault tolerance by removing central points of control and failure. Honestly, at this point, I was nauseous and angry at the level of charlatanry. Oh by the way - every single file you store with their system is 5% larger because of the encryption needed and every single time you alter one of your files you have to pay gas fees. I can’t, if you want to feel as sick as me, go ahead and read their white paper here - Trash paper. It's 25 pages of sadness.

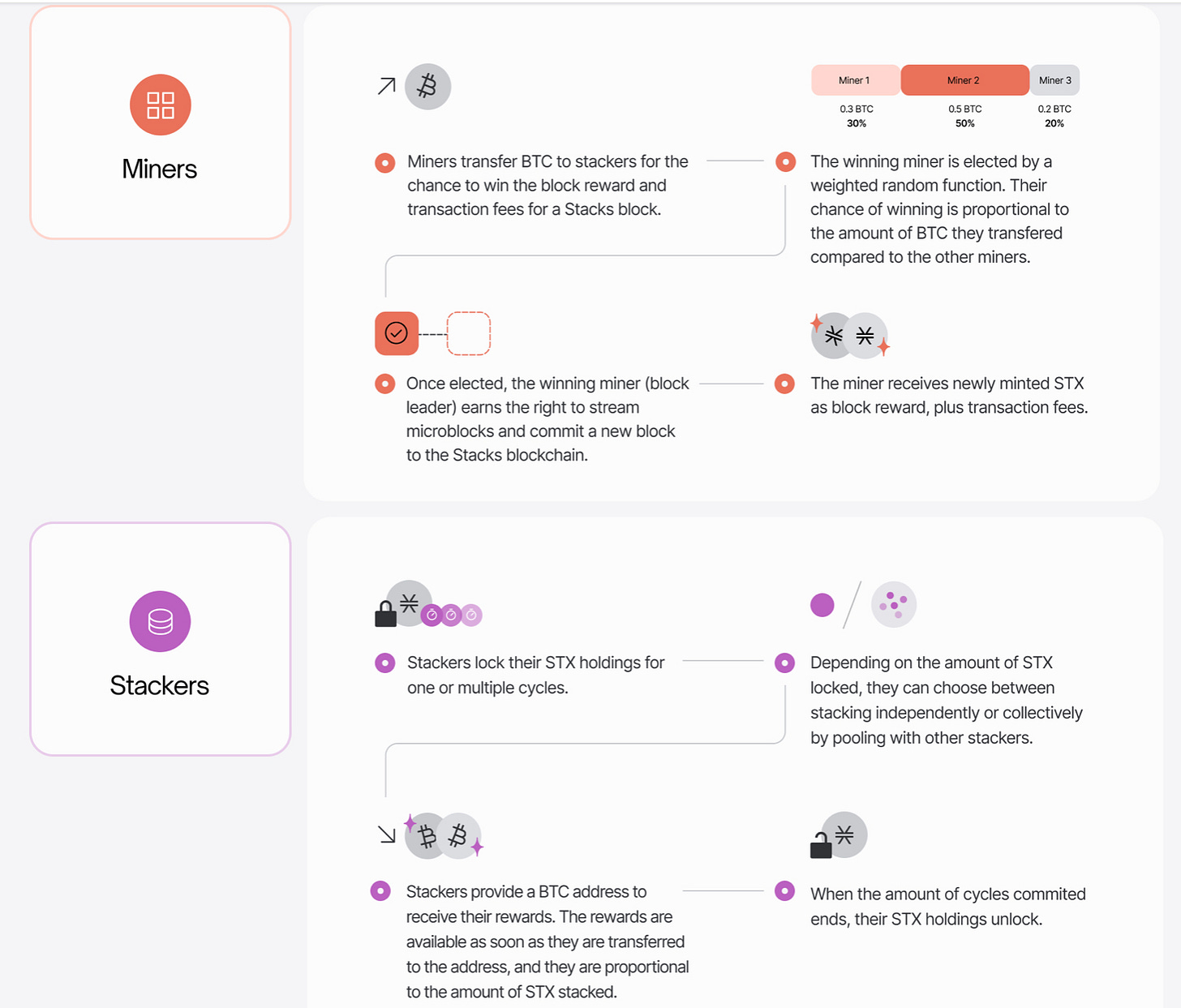

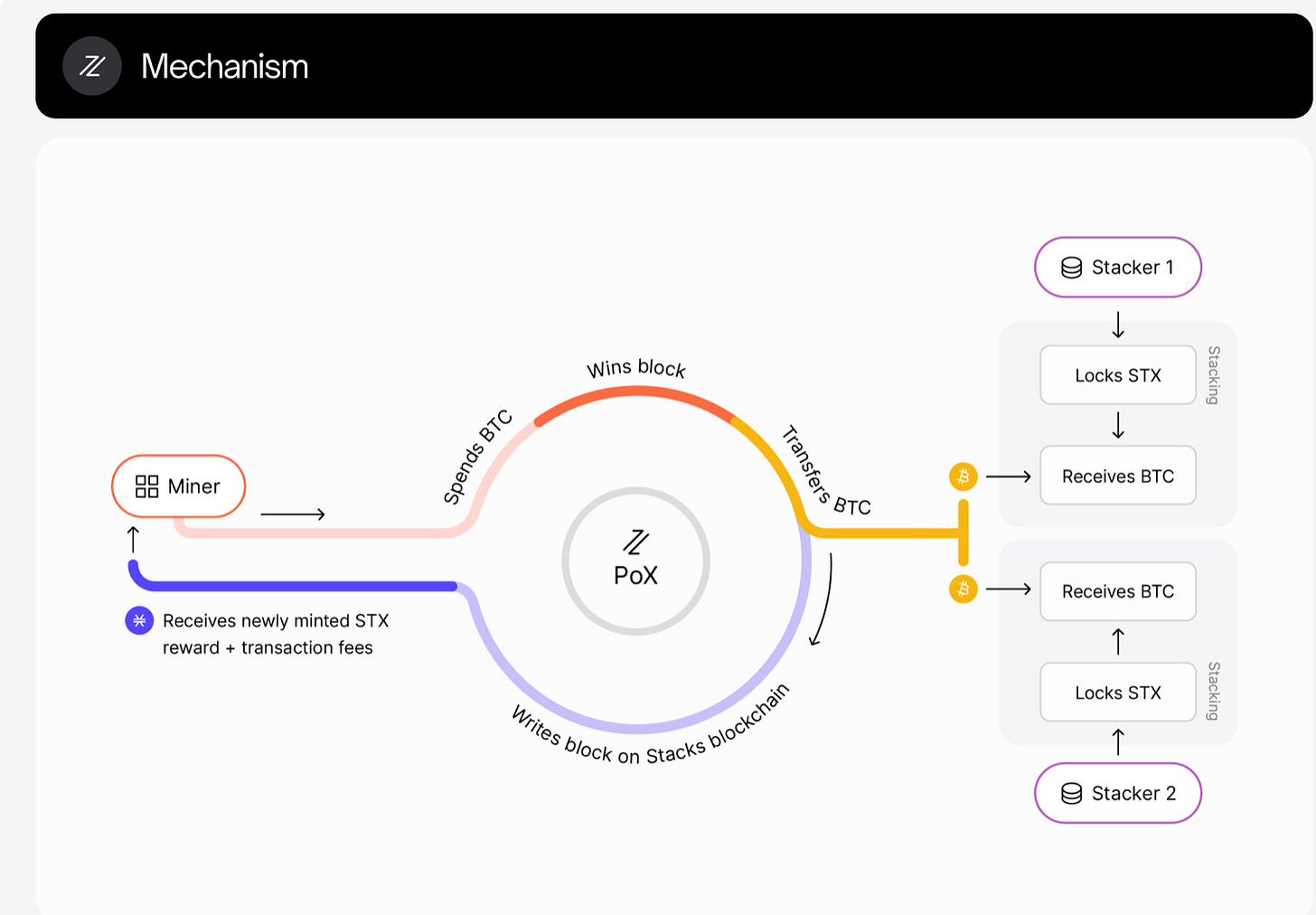

So, it turned out that proof-of-burn was a stillborn idea. SURPRISE, SURPRISE! I am no genius, nor do I have a Ph.D., like some of these “geniuses” that are trying to “improve/build onto” Bitcoin, but I saw this coming. In a newer white paper called “proof-of-transaction (PoX)” - (essentially releasing Stacks Blockchain v2.0), the super geniuses at stacks blockchain, say that they realized that participants of PoB may be unwilling to destroy Bitcoin to participate in stack blockchain. Pox introduces more complexity to the chain, and here is where these types of blockchains realize that there is no way to operate these travesties without the introduction of said complexity. Reading through the explanation or PoX is dense and hard to understand, but this doesn’t mean that this complexity makes the chain better. Often the ideas that are simple and easy to grasp are usually the ideas that are the most successful. PoX ignores a lot of how we, humans, are incentivized economically. These engineers are trying to create a new system of economic incentives, to make their blockchains operate and this is their biggest flaw and blindspot. Game theory ? ( What is game theory?)

They claim Stacks 2.0 is a layer 1 blockchain - what does this mean? First of all, this means that it is a completely separate blockchain from Bitcoin. Second, it means it is not a protocol as lightning is, that communicates directly with the Bitcoin blockchain. If anything stacks blockchain is closer to liquid or drivechain or rootstock - Bitcoin side chains, but worse. These existing side chains don’t claim to be a part of Bitcoin or Building on top of Bitcoin - Stacks blockchain throws this idea around as if it had no weight at all. For more detailed information on sidechains please visit This link.

There is absolutely no direct relationship or connection between this parasitic chain and Bitcoin. As shown in the diagram above - the only way Stacks Blockchain interacts with Bitcoin is as Bitcoin passes from the miner’s Bitcoin wallet to the receiver's Bitcoin wallet, and it is very important to note that in the process of transferring the Bitcoin from the wallet to wallet all the stacks chain is doing is looking at the Bitcoin chain, just looking at it nothing else. That is it. Stacks do not ever touch Bitcoin. It can’t - Nothing Can’t. Bitcoin is a self-contained protocol, and that is what makes it as secure as it is. I like to use this analogy, Stacks (STX) is like a passenger at a train station looking at a digital clock (Bitcoin) for reference, and the clock is telling him to rush to catch a high-speed train of complexity (Stacks Blockchain) that will most likely derail at full speed with all of its passengers with it.

Looking at the chart above, it is quite obvious that this project’s incentives are completely broken, even after the implementation of their PoX mechanism. The Centillion effect is in full force. This means that the people that get in first and are the closest to the source of value, the ICO (initial coin offering), always retain the upper hand in that economy. The initial investors in Stacks will always be the ones rewarded the most, and in all likelihood, the ones using you as exit liquidity once this whole thing collapses. Stacks enable what I term a “circle jerk incentive” between all the big whales. A circular loop, in which the people with the most STX become the ones receiving the most BTC and in turn become the miners with the most BTC transacted to gain the ability to mine blocks and receive more STX.

The devs have also seen these issues and pointed them out in their PoX white paper. So what did they do? COMPLEXITY! Yey! See the pattern? For every problem, they try to solve they inherently add complexity which in turn leads them to add more “solutions” that keep adding complexity. This is what Ethereum has been dealing with since its inception. This is what every last shitcoin becomes trying to one-up Bitcoin.

So far the genius devs, trying to patch this sinking ship have created Anchor blocks and Sunset blocks which makes me wonder if there will ever be a “from dusk til dawn” block (great movie by the way). All this to solve miner consolidation through an effort they call “time bounded PoX” which essentially would roll back the whole chain to a PoB consensus mechanism. Miner consolidation is a huge hurdle they won’t ever overcome without making the chain a Frankenstein abomination of complexity and chaos. A non-honest miner could literally through PoX fork the stack chain with a block that claims to hold a large fraction of STX tokens - this miner will proceed to issue blocks that pay all of the fees for itself. The second suggestion for solutions is to not allow the miners to be holders of STX tokens by implementing another blockchain! And this blockchain would be started through another trusted entity - this entity would require another system to ensure compliance with legal contracts. They admit at this point that their blockchain would be more of a federated system. This problem will ultimately lead to the centralization of an already centralized Stacks Blockchain. YIKES!

If all of this travesty has not made you run away from using your hard earn and invaluable Bitcoins in this septic tank of a project, what is coming might?

Stacks Blockchain’s parent company Hiro PBC (Formerly Blockstack PBC) and their board will periodically consider if the Blockstack network is decentralized enough for the Stacks Blockchain to be treated as a non-security in the US. This is never happening. And if by some miracle, it happens, all the people that are invested in this project in one way or another will be impacted negatively. There is a memorandum from Wilson Sonsini (the legal representative of Hiro PBC). In this memorandum Blockstack or Hiro or whatever controls Stacks Blockchain, claim that they are no longer a security because they will no longer be considered to provide the essential managerial services as the sole or primary factor in generating potential returns to investors. I just puked in my mouth a little. They claim that after the stacks blockchain 2.0 is fully released, PBC will play a significantly reduced role, and no longer have the ability to, among other things, unilaterally make changes to the stacks blockchain, issue stack (STX) tokens, or otherwise control or even necessarily influence the development of the stacks blockchain and tokens. They say that after the release of v2.0 its primary business will be to develop apps and developer tools to be used on the stacks blockchain in competition with any other developers. LOL rekt. They are planning to turn against the community of devs they are fostering. The devs that are helping them grow their brand’s user base. These people want to wash their hands from the SEC ICO era, and collect $200 as they pass go while they soft rug everyone else involved when inevitably this malformed from inception mega complicated Rube Golberg monstrosity collapses under its own weight. Link to the full memorandum - SEC Memo.

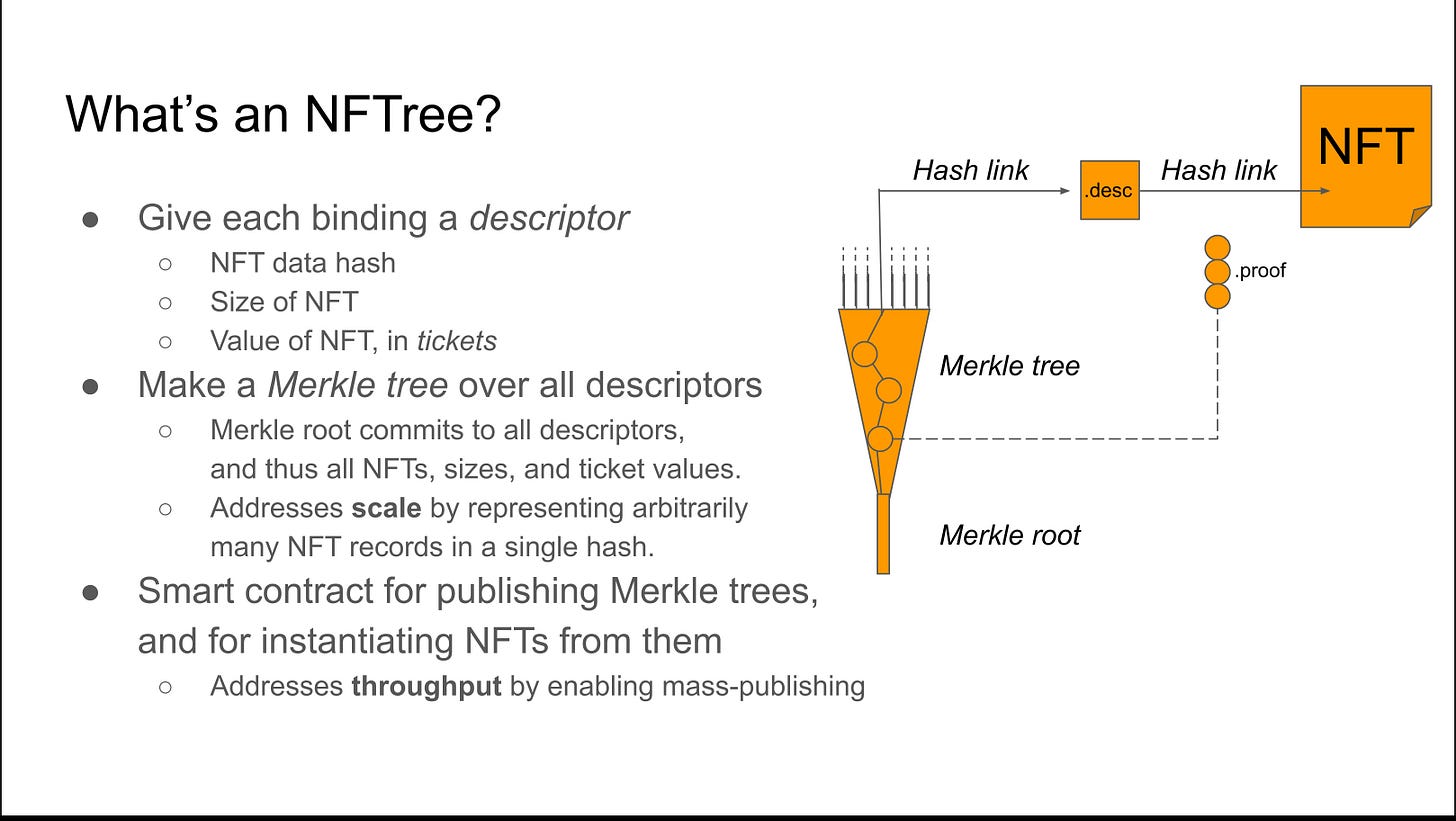

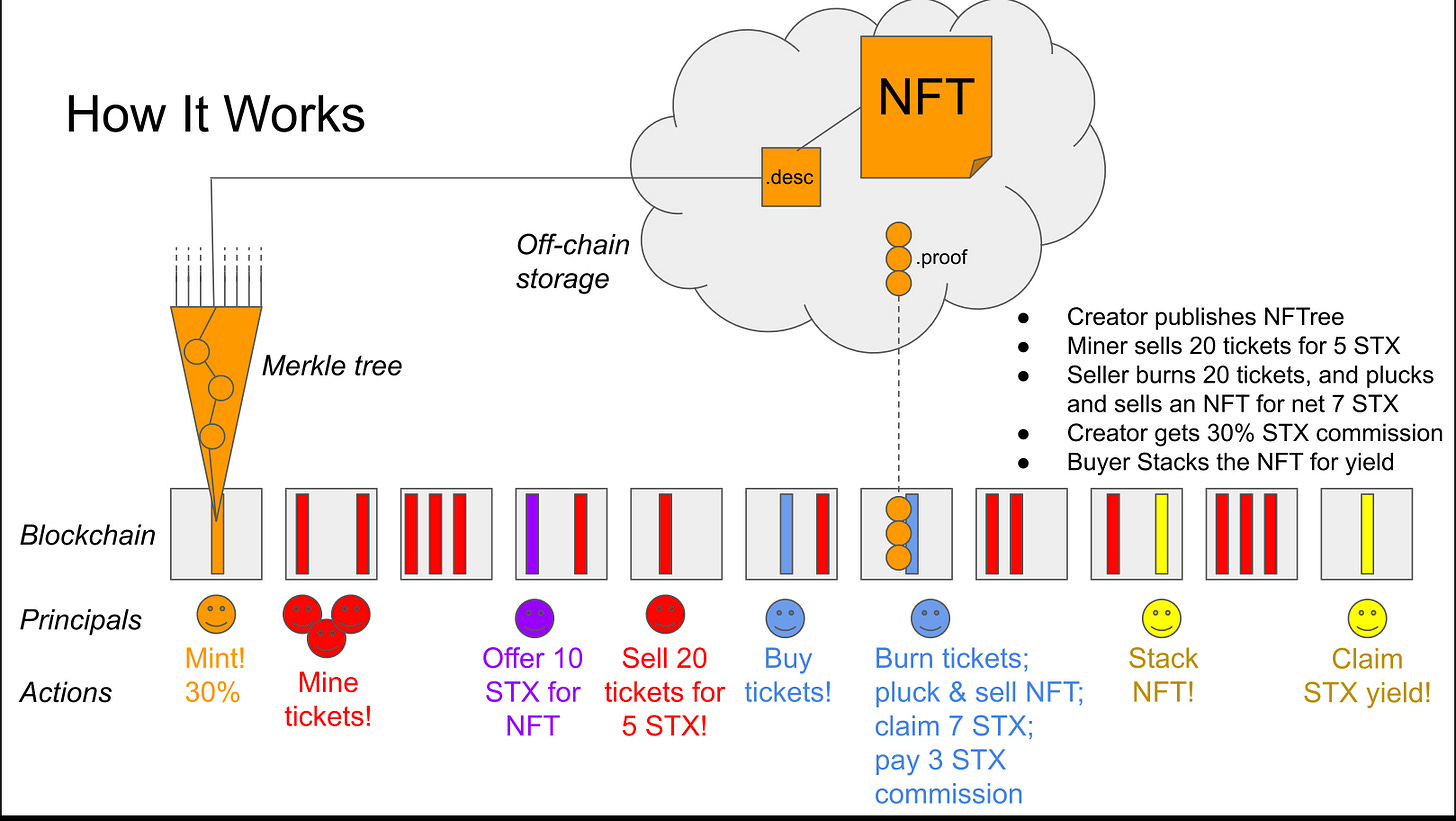

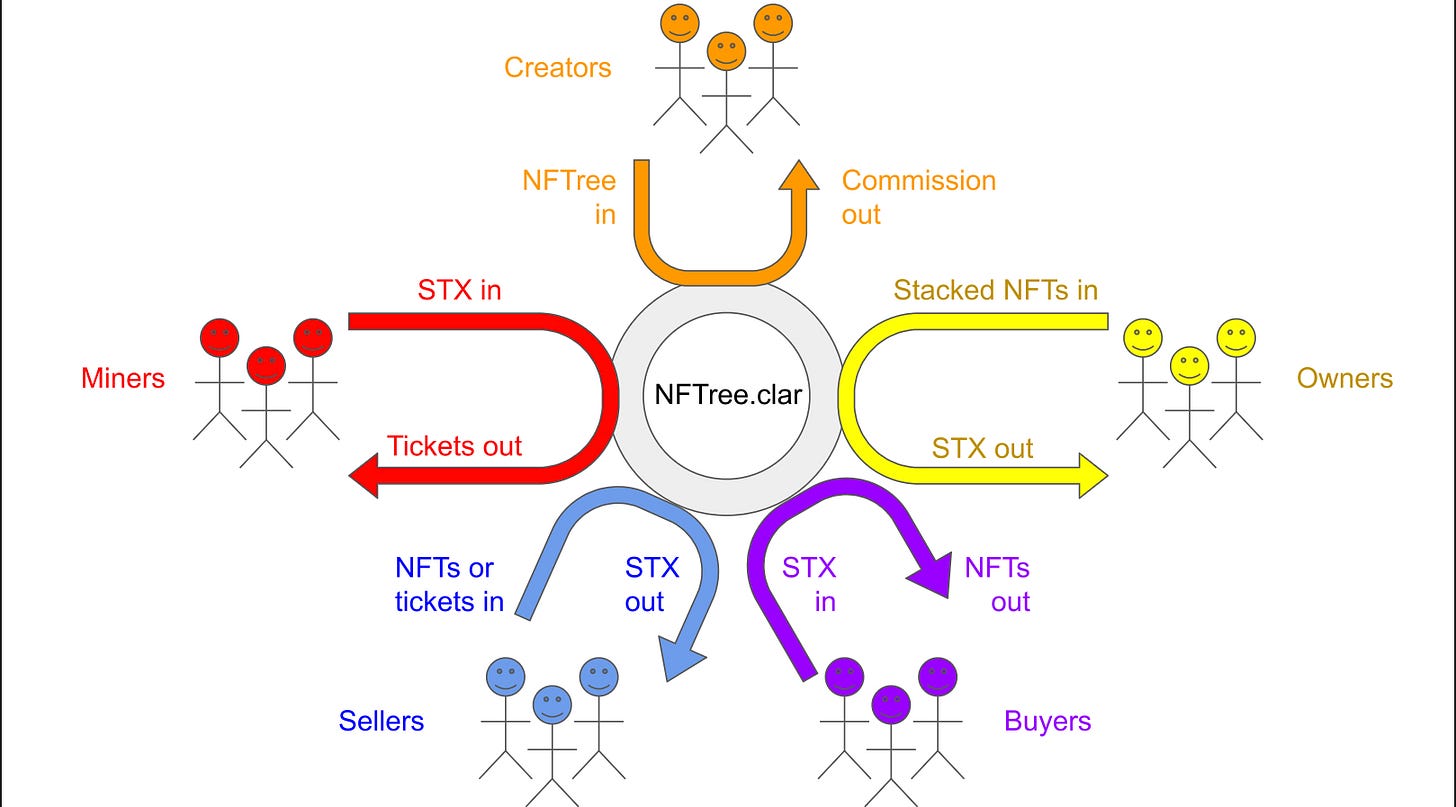

While they are at it, they are running the ball forward onto more shitcoinery when they have not even solved all of the issues currently present on their 2.0 version of the Stacks Blockchain - They are creating NFTs! And not only plain old lame NFTs, NO! These are motherfucking YIELD generating NFTs, take that Bored Apes! They also have something called Hyperchains, but really they don’t call those that anymore, they are Subnets, because someone forgot to make sure that name was not being utilized or registered to someone else. Come on, guys! That is simply just lazy. All the documentation online still says Hyperchains though. Take a look at some of the inspired diagrams I found on a slideshow they have up on somewhere on their site. The last one is my personal favorite.

The truly dangerous aspect of this shitcoin is that it claims they are bringing evolution to Bitcoin by adding web 3.0 functionality to it when this is not true at all. They claim they are “unlocking” hundreds of millions in bitcoin capital because holders of bitcoin have a great new opportunity to use and earn bitcoin. Their tactic is morbidly grotesque and truly disgusting. They claim that bitcoin and stacks work in tandem to enable novel ways of using bitcoin. Really? There’s absolutely nothing novel about what they are doing for all the reasons explored and presented in this article. They promise bitcoin holders access to all of these “amazing” apps they have developed by staking your precious bitcoins to get their shitcoin STX to use these apps. I believe their tactic will captivate many new Bitcoiners, and sadly they will end up giving away their invaluable coins.

I came up with a very interesting analogy while writing this piece. Its relation is more akin to a passenger at a train station looking at a digital clock (Bitcoin) for reference that tells him to rush to catch a high-speed train of complexity (Stacks Blockchain) that will most likely derail at full speed with all of its passengers in it. Aboard this train at your own risk! or rather - never even consider buying a ticket to board it.

I know that inevitably there will be people that learn a very tough lesson here, and no matter how it is presented to them that this project is nothing more than an affinity scam, they will jump in. They will be lured by the prospect of being able to “multiply” their bitcoin holding’s presented by the Stacks Blockchain. This is nothing but a show of smoke and mirrors. I hope that this article will reach at least one new bitcoiner in the hopes that he or she understands that the bitcoin they hold is truly worth more being held offline, in non-custodial wallets than in the hands of these scammers. Stay humble, provide value, and stack SATS!

The fact none of the following things were mentioned even once shows how bad and incomplete this article is, and how biased the author is:

DeFI , DEX , Clarity , smart-contract , Dapp , and I could go on.

There are also *glaring* errors that show a lack of understanding the technical details of how the blockchain works.

It's simple, Bitcoin does not have a full featured smart-contract language and will not for many years to come, if *ever*, and Stacks' "Clarity" programming language brings this vital missing piece to Bitcoin.

Stacks is a "layer 2" protocol that runs "on top" of Bitcoin bringing new capabilities that other L2's like Lightning, RSK, and Liquid cannot do or don't do very well.

Shem.